Hyperlinks In Gold Below

Home > crypto101 > What is Bitcoin? A complete guide for cryptocurrency beginners

Audio version is available. Click to listen now!

What is bitcoin?

As an easy start, think of bitcoin as some “numbers” stored on the Internet. As more and more people start to trade bitcoin, it gradually becomes a more recognized medium of exchange. Bitcoin has been referred by some as the currency of the Internet.

Who created bitcoin?

Bitcoin’s birth could be traced back to 2008, when someone under the name “Satoshi Nakamoto” (whose real identity is still a mystery) published a paper called “Bitcoin: A Peer-to-Peer Electronic Cash System” (full paper here). The title of the paper captures two important features of Bitcoin:1

- Peer-to-Peer : Bitcoin allows direct P2P payments without 3rd-party intermediaries such as banks or payment processors. This is a major reason why Bitcoin is commonly regarded as a highly “decentralized” currency;

- Electronic Cash : There have been many past attempts to develop electronic cash, but what makes Bitcoin stand out is its clever use of existing technologies like cryptography and distributed system to make it highly secure and efficient.

How does bitcoin work?

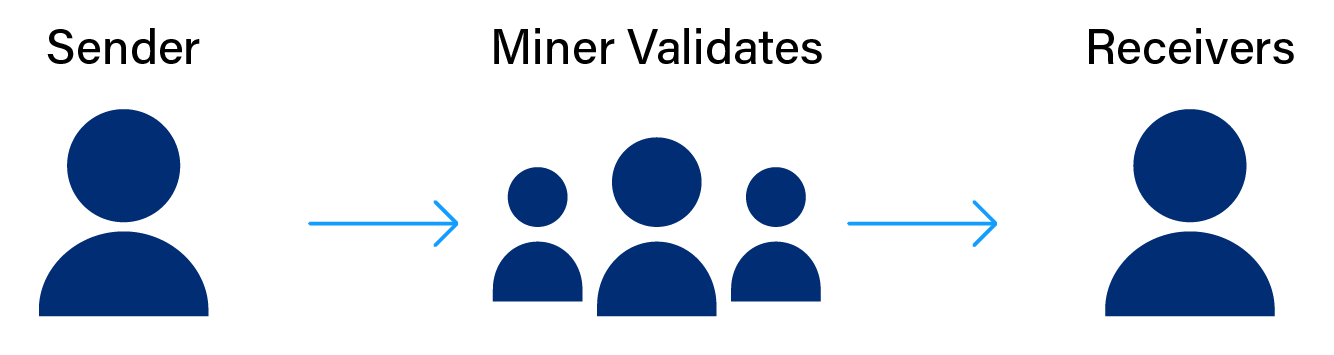

Bitcoin uses blockchain technology to make the system work. Normal users like you and me can use it to send and receive money easily, but the real difficult work underneath is handled by miners.

Miners are a specialized group of people who are responsible for maintaining the Bitcoin system. They may or may not know each other, and everyone (including you!) are welcome to join.2

Miners need to spin up machines with a lot of processing power to store the data, handle and broadcast transactions, and solve a complex mathematical puzzle (called Proof of Work) to reach consensus. When you send a new transaction to the Bitcoin network, miners will pick up your transaction and do all the complicated work mentioned above under the hood.

You may wonder why miners would volunteer to maintain this decentralized network. That’s because they are not doing their work for free. Miners are incentivised to do so by receiving mining rewards and transactions fees. (Of course, paid in bitcoin!).

We’ve covered enough material for you to get a basic understanding of bitcoin. But if you are interested in learning more, visit our article here for a deep-dive into the technological aspects of Bitcoin!

Why is bitcoin so revolutionary?

Here is our view:

Bitcoin is the first payment network that is fully autonomous and self-sustaining3, where no single party or incidence can intervene or terminate the system. You can use it anytime, anywhere in the world as long as you have internet access.

It paves the way for the next technological revolution since the Internet - a global digital currency without middle-man fees.

Limited supply (lead to scarcity → digital gold)

Other interesting aspects of bitcoin (and cryptocurrencies in general) include things like;

- Relatively fast settlement (1 hour versus 2 days for wire transfer)

- Potential to develop applications on top of it (e.g. smart contract)

Everyone has different reasons to love bitcoin (and other cryptocurrencies). We encourage you to join us and find your own view on why it is so revolutionary!

Why are there so many different cryptocurrencies besides bitcoin?

Alternative coins (altcoins) are the other cryptocurrencies out there that are not bitcoin. Different altcoins exist for their own purposes, similar to why we see many different companies in our economy. They exist with different visions, users, or because they have an edge that others do not have.

This is also the case for cryptos. Examples like Litecoin (LTC) and Bitcoin Cash (BCH) share bitcoin’s features but have faster transactions. Ethereum (ETH) and EOS focus on providing an open platform for writing smart contracts and building decentralized applications (DApps).

There is a simple classification of cryptocurrencies:

- Cryptocurrencies / payment tokens

- Security tokens

- Utility tokens

They are tokens that are used now or in the future to pay for goods, services, or money transfers.

They represent credit or debt, for example, a share in future company earnings or future capital flows.

They are created to provide digital access to an application or service, blockchain based infrastructure.

For Crypto.com, our MCO token acts as a utility token for you to reserve the MCO Visa card and get benefits of various services like preferential interest rates for Crypto Earn and Crypto Credit.

For Crypto.com, our Crypto.com Coin (CRO) acts as a utility token for you to reserve the Visa Card and get benefits of various services like preferential interest rates for Crypto Earn and Crypto Credit.

It also acts as a payment token which allows you to use Crypto.com Pay to purchase gift cards from brands worldwide using cryptocurrencies and get up to 10% back.

As of today, there are over 2,000 different cryptocurrencies. You can track the top 200+ of those in our Crypto.com App, or explore their price movements in our price page. Cryptocurrencies are still innovating and adapting. The market will decide which ones will eventually survive and gain mainstream adoption.

Is bitcoin safe?

Yes and no. While the Bitcoin network is reasonably safe (and has endured real-life usage for over 10 years), it is equally important for users to be cautious of how they store crypto and protect their keys as users often lose their access or compromise it.

To keep your cryptocurrency holdings safe, you can store your cryptocurrencies on professional wallets using an institutional grade storage solution that offers customer service support. Stay away from phishing websites, and you should always keep your password confidential. Read more on how to keep your money safe here.

How is the cryptocurrency market different?

We think there are many reasons. Key points below:

- It is the only asset class that can be traded 24 hours a day, seven days a week.

- It is a global market without geographical barriers.

- It is the first payment network that is fully autonomous, self-sustaining, and decentralized.4

- It is a liquid and highly efficient market (for major cryptocurrencies).5

- It is a new and high growth market which attracts lots of talent and capital.

- Highly volatile (some may like it, some may not).

Should I invest in cryptocurrency?

It’s totally up to you to decide whether you should invest in crypto. Here are a few things you should consider before investing in cryptocurrencies:

- Evidence suggests that cryptocurrency has a low correlation with other tradable financial assets, hence it may provide diversification benefits.6

- The underlying blockchain technology is improving with thousands of research papers being published every year.

- The cryptocurrency ecosystem (cryptocurrency projects, start-ups, investors, etc.) is maturing everyday. More interest is being shown by institutional investors, MNCs, and regulators.

- With reference to historical figures, this area is under rapid growth.

To conclude, cryptocurrency is an emerging new asset class that you should definitely consider to add into your portfolio.

References

1. Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System, 1–9. Retrieved from https://bitcoin.org/bitcoin.pdf

2. Beck, R. (2018). Beyond Bitcoin: The Rise of Blockchain World. IEEE Computer Society, 51(2), 54–58. Retrieved from https://ieeexplore.ieee.org/stamp/stamp.jsp?tp=&arnumber=8301120

3. Hsieh, Y.-Y., Vergne, J.-P., Anderson, P., Lakhani, K., & Reitzig, M. (2018). Bitcoin and the rise of decentralized autonomous organizations. Journal of Organization De Kajtazi, A., & Moro, A. (2018). The Role of Bitcoin in Well Diversified Portfolios: A Comparative Global Study. SSRN Electronic Journal, 12–12. doi: 10.2139/ssrn.3261266sign, 7(1). doi: 10.1186/s41469-018-0038-1

4. Hsieh, Y.-Y., Vergne, J.-P., Anderson, P., Lakhani, K., & Reitzig, M. (2018). Bitcoin and the rise of decentralized autonomous organizations. Journal of Organization Design, 7(1). doi: 10.1186/s41469-018-0038-1

5. Wei, W. C. (2018). Liquidity and market efficiency in cryptocurrencies. Economics Letters, 168(July 2018), 21–24. doi: https://doi.org/10.1016/j.econlet.2018.04.003

6. Kajtazi, A., & Moro, A. (2018). The Role of Bitcoin in Well Diversified Portfolios: A Comparative Global Study. SSRN Electronic Journal, 12–12. doi: 10.2139/ssrn.3261266

reprinted from...

PARTAKE, ENJOY, PROCEED!